unlevered free cash flow vs levered

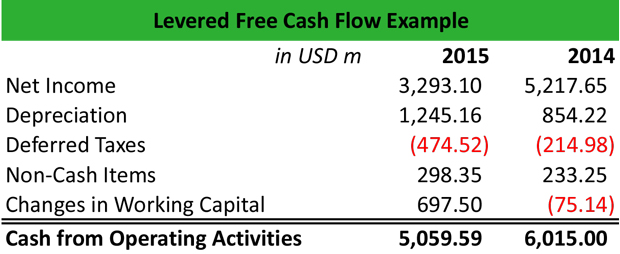

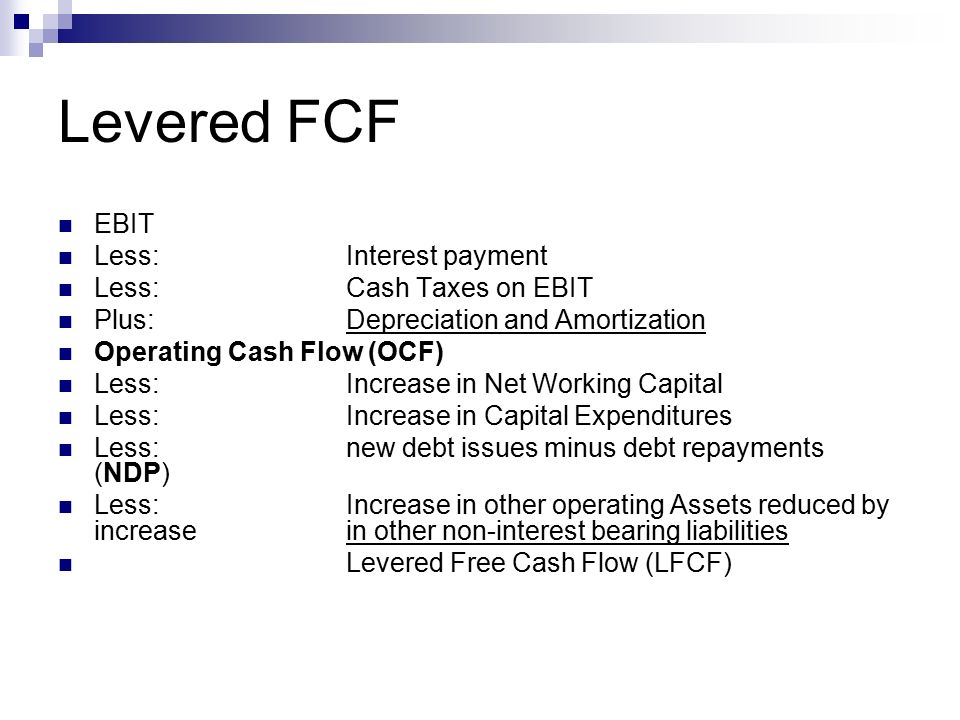

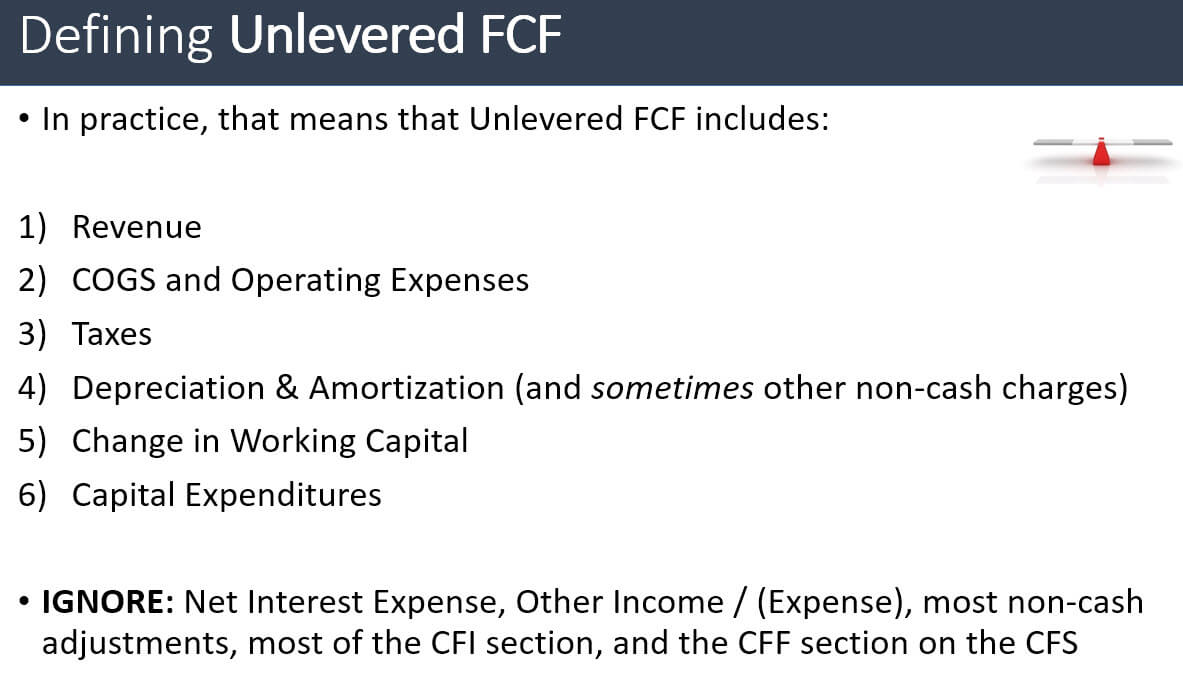

Levered free cash flow is the amount of cash a business has after paying debts and other obligations. Excludes interest expense and ALL debt issuances and repayments.

Understanding Levered Vs Unlevered Free Cash Flow

The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

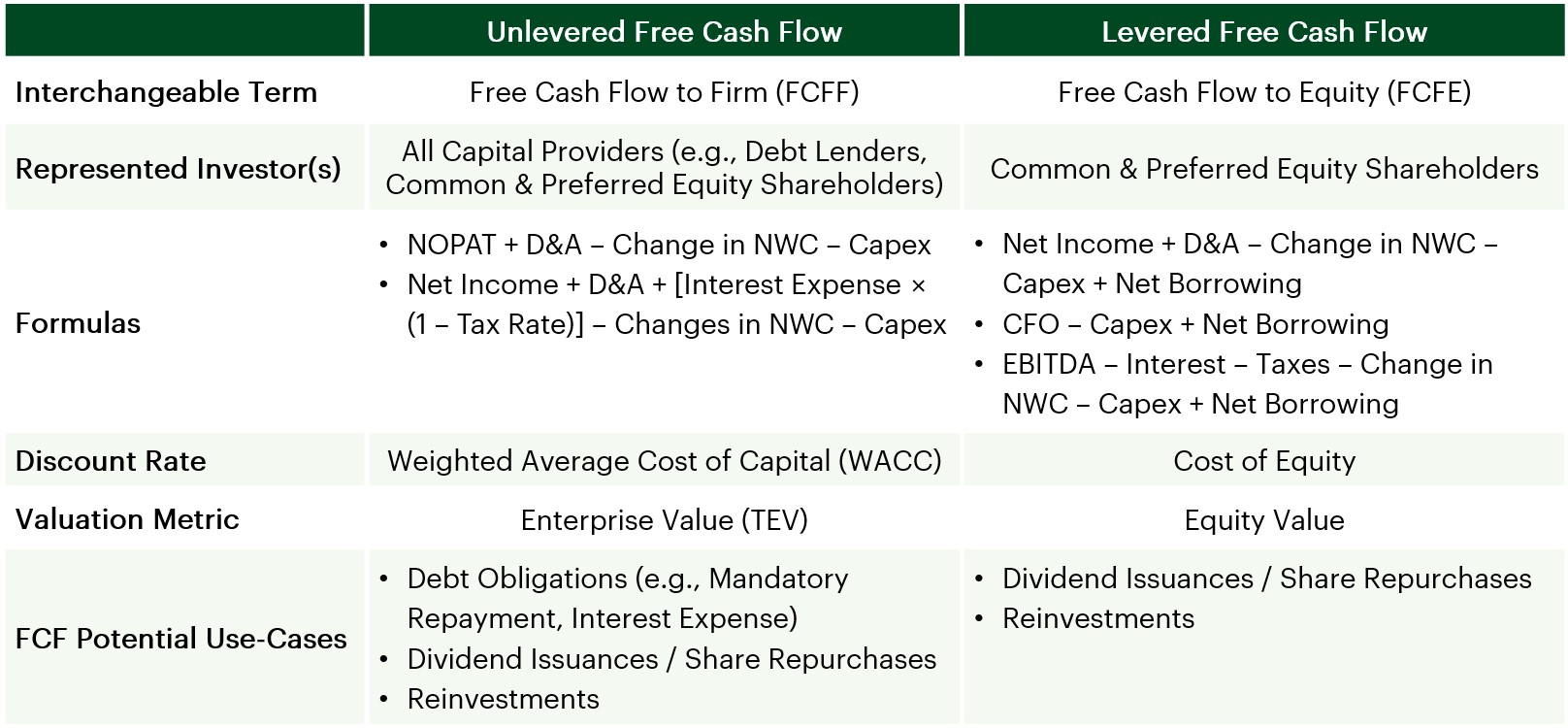

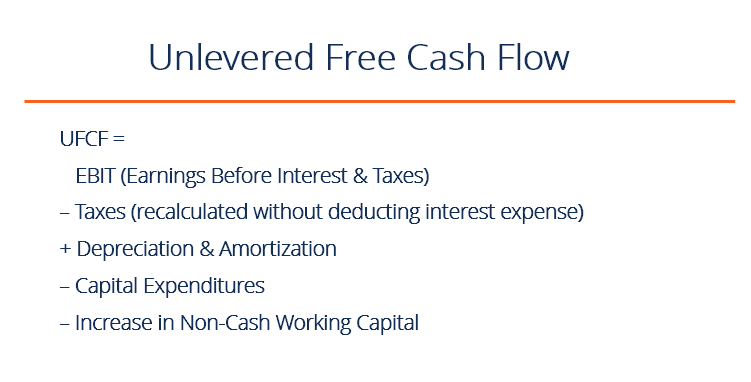

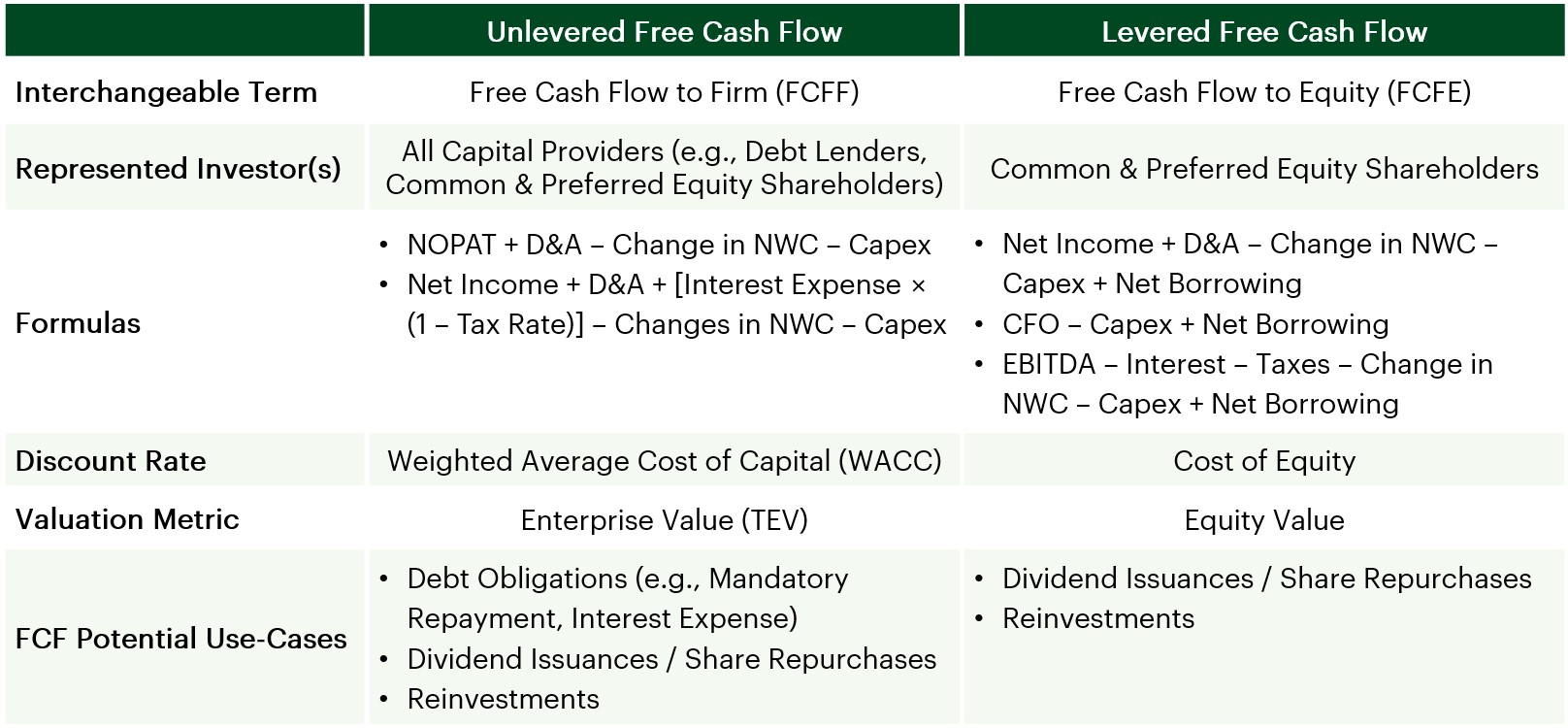

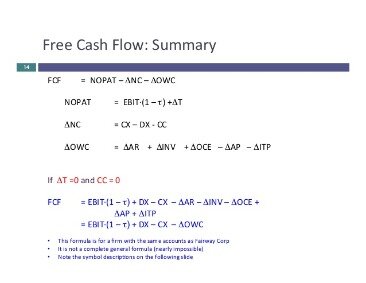

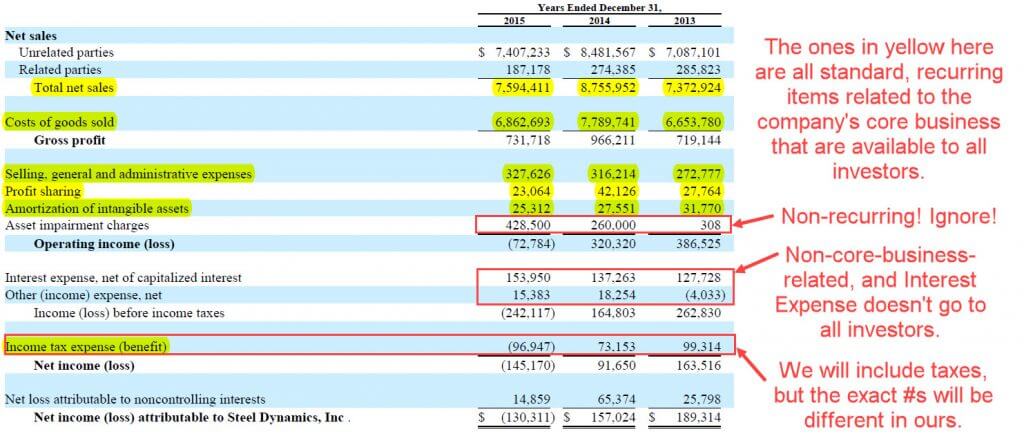

. The key difference between Unlevered Free Cash Flow and Levered Free Cash Flow is that Unlevered Free Cash Flow excludes the impact of interest expense Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Enterprise value is a measure of the companys. Unlevered cash flow represents the money you have before paying all those bills.

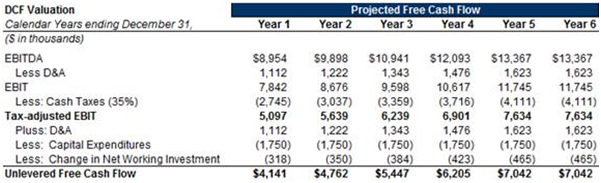

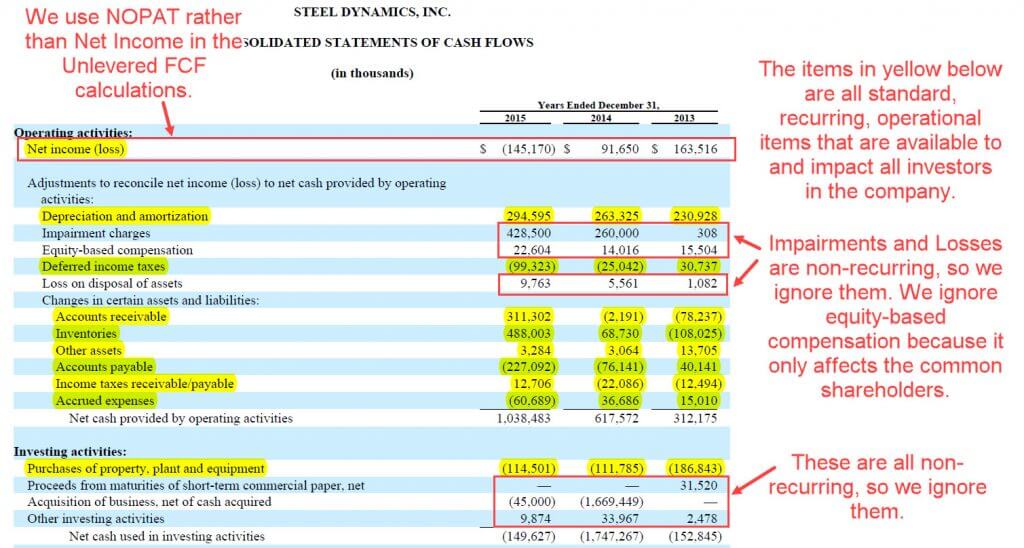

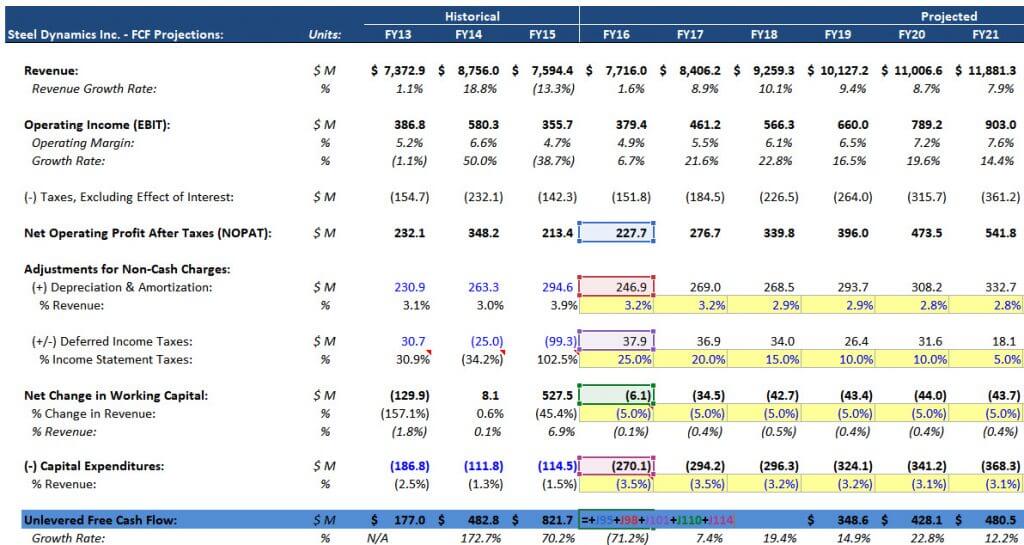

Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. Top Down starting with EBITDA vs Bottom Up starting with Net Income. In case the financing structure or interest rate changes IRR levered will change as well whereas the IRR unlevered stays the same.

Unlevered cash flow is the amount of cash that a property produces before taking into account the impact of loan payments. Therefore we can derive levered. Cash Flow from Operations CapEx.

Unlevered cash flow is the amount of. Levered and unlevered free cash flow are concepts that stem from the term free cash flow. Unlevered Cash Flow cannot be considered in isolation because it does not incorporate the payments that are to be made to the debt holders.

Includes interest expense and mandatory debt repayments but opinions on this differ. Used to value equity with a Cost of Equity discount rate only if there are no bondholders andor preferred shareholders FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise. Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors.

Levered free cash flow shows the amount of funds that are left over once debt and interest on debt are paid. On the other hand Unlevered Free Cash Flow provides a more attractive number of free cash flow than Free Cash Flow and Levered Free Cash Flow since it excluded interest payments. Unlevered free cash flows indicate a companys cash flow pre-interest expense.

It is also thought of as cash flow after a firm has met its financial obligations. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. Plus to make a comparison between companies UFCF is more favored.

Thus a positive LFCF illustrates a companys ability to cover all financial obligations distribute dividends and grow. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off.

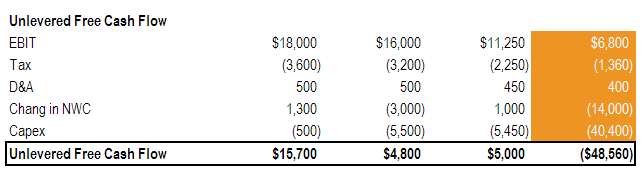

Levered cash flows indicate a companys cash flow post-interest expense. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF EBIT 1-tax rate DA ΔNWC CAPEX. FCFE 5000 500 200 -770 -2750 -550 1630.

The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. The difference between UFCF and LFCF is the financial obligations interest and principal. Using the figures for Company A and assuming the firm has a debt repayment of 550 we can calculate the FCFE as.

Start from first principles. FCFE EBIT - Taxes. What is Levered Free Cash Flow.

When you take a look deeper into the cash flow metrics within PBFX you will find that free cash flow per share has been increasing since 2019 although both levered and unlevered free cash flow. Whereas levered free cash flows can provide an accurate look at a companys financial health and the amount of cash it has available unlevered cash flows provide a look at the enterprise value of the company. Its principal application is in valuation where a discounted cash flow DCF model DCF Model Training Free Guide A DCF model is a specific type of financial model used to value a business.

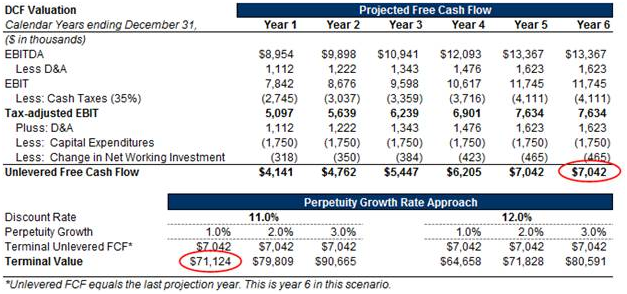

IRR levered includes the operating risk as well as financial risk due to the use of debt financing. Its a better indicator of financial health. Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders.

Levered Free Cash Flow is considered to be an important metric from the perspective of the investors. Like levered cash flows you can find unlevered cash flows on the balance sheet. Unlevered free cash flow is the gross free cash flow generated by a company.

Unlevered free cash flow is important to financial health because it highlights the gross cash amount. Includes interest expense but NOT debt issuances or repayments. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis.

Levered cash flow is the amount of cash that a property produces after operating expenses and debt service. Levered Free Cash Flow. Unlevered Free Cash Flow vs Levered Free Cash Flow Unlevered Cash Flows.

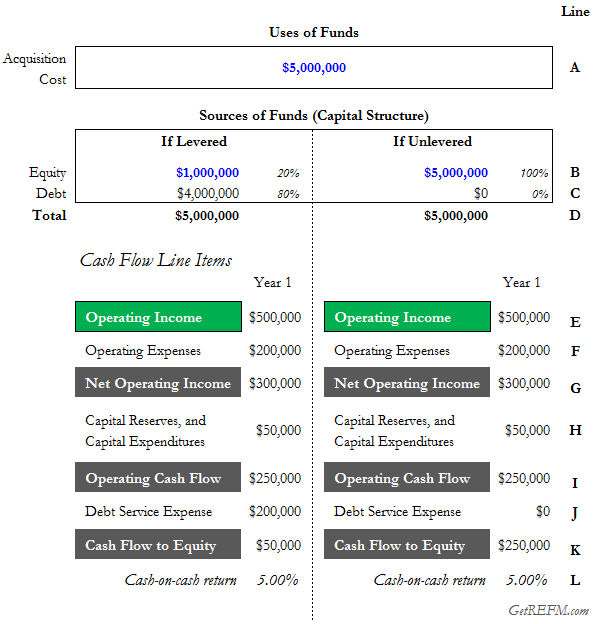

Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. Cash Flow before the Impact of Debtl Free Cash Flows. The most important application of these concepts is when calculating return metrics like cash on cash.

Levered cash flow vs. Choosing the appropriate cost of capital and Timing Issues when discounting Cash Flows. Unlevered free cash flow is the amount of cash a company has prior to making its debt payments.

Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more comparable. This is because a business is liable for paying its debts and expenses in order to generate a profit. Unlevered cash flow vs.

On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. Levered free cash flow is often considered more important for determining actual profitability. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115.

Free cash flow Levered cash flow is the amount of money your business has left over after paying all bills and other financial obligations including operating expenses interest payments etc. Unlevered Free Cash Flow. Cash Flows after all Operating Expenditures Calculating UFCF.

Levered cash flow is the amount of free cash available to pay dividends the amount of cash available to equity holders after paying debt In some models analysts will use leveraged free cash flows as only.

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Fcf Yield Unlevered Vs Levered Formula And Calculator

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Wave Accounting

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

What Is Free Cash Flow Calculation Formula Example

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial